When severe weather strikes Greenville, homeowners face immediate concerns about property damage and repair costs. Understanding exactly what your Greenville homeowners insurance policy covers—and what it doesn’t—can mean the difference between a smooth recovery process and unexpected financial burden.

Most standard homeowners insurance policies provide robust protection against certain types of storm damage, but significant gaps exist that catch many property owners off guard. The key lies in knowing these distinctions before disaster strikes, allowing you to make informed decisions about additional coverage and claim preparation.

This guide breaks down the specific storm damage scenarios covered by typical Greenville homeowners insurance policies, identifies common exclusions that leave homeowners vulnerable, and provides actionable steps for documenting and filing claims when storms cause property damage.

What Storm Damage Your Homeowners Insurance Typically Covers

Wind Damage Protection

Standard homeowners insurance policies generally provide comprehensive coverage for wind damage, including damage from hurricanes, tornadoes, and severe thunderstorms. This coverage extends to your home’s structure, including the roof, siding, windows, and doors, as well as detached structures like garages and sheds.

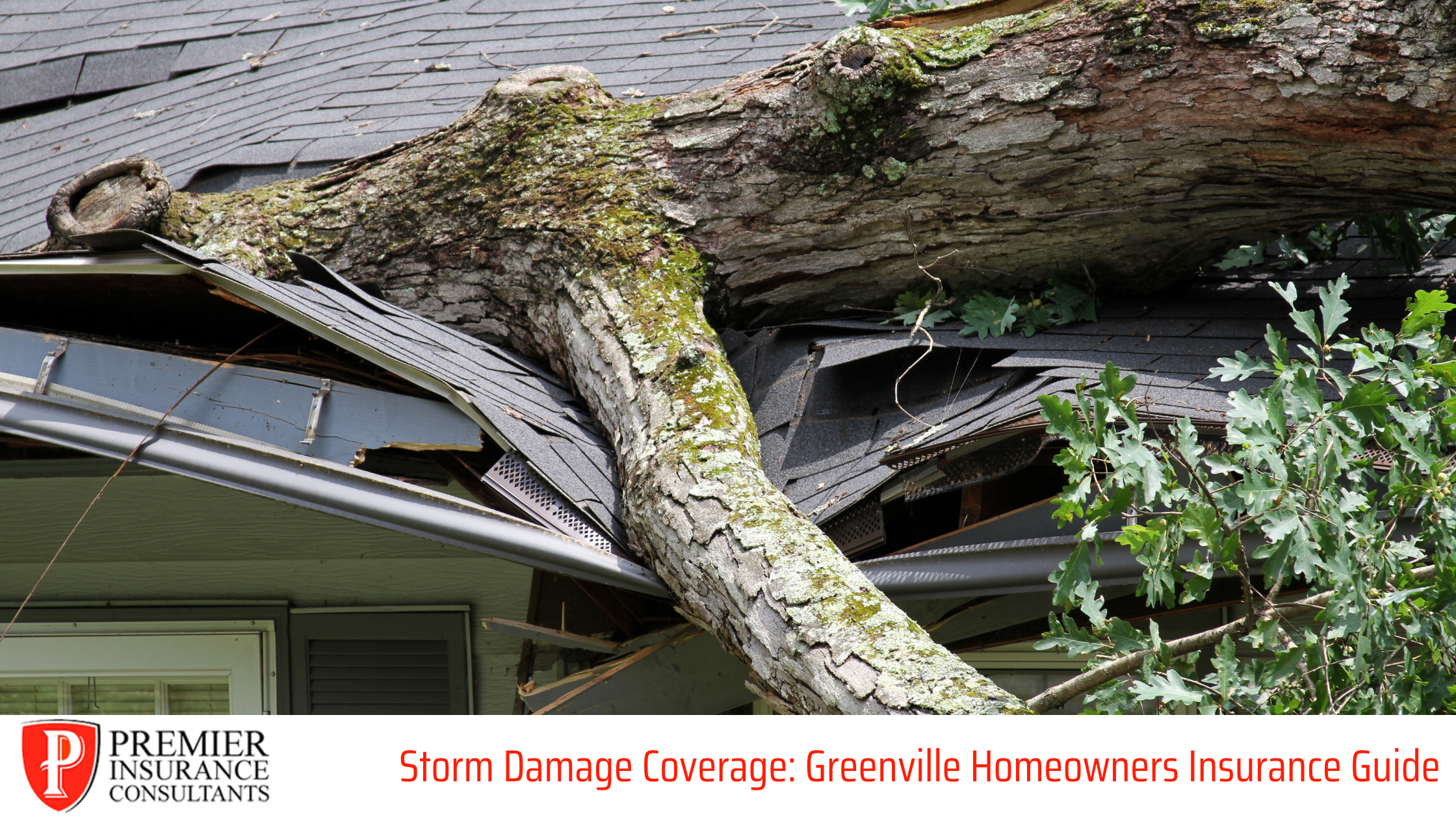

Wind damage coverage also applies to personal property damaged by wind or debris carried by wind. If a tree falls on your home due to wind, both the structural repairs and removal of the tree are typically covered. However, if a tree falls without wind involvement—due to disease or age—coverage may not apply.

Most policies include protection against windstorm damage to landscaping and outdoor equipment, though coverage limits often apply to these items. The specific wind speed threshold that triggers coverage varies by policy, so reviewing your specific terms ensures you understand when coverage applies.

Hail Damage Coverage

Hail damage represents one of the most common storm-related insurance claims in South Carolina. Standard Greenville homeowners insurance policies typically cover hail damage to roofing materials, siding, windows, and outdoor equipment like HVAC units and vehicles parked on your property.

Coverage extends beyond obvious damage like broken windows or dented siding. Hail can cause granule loss on asphalt shingles, micro-cracks in roofing materials, and damage to gutters and downspouts that may not be immediately visible but can lead to long-term problems if left unaddressed.

Your policy should cover the full cost of repairs or replacement when hail damage occurs, minus your deductible. Some insurers offer separate wind and hail deductibles that may be higher than your standard deductible, particularly in areas prone to severe weather.

Water Damage from Storms

Homeowners insurance provides coverage for water damage that results directly from covered storm events. This includes water that enters your home through storm-damaged roofs, windows, or siding. If wind damages your roof and rain subsequently enters your home, both the roof repair and interior water damage typically receive coverage.

Coverage also applies when storms cause pipes to burst due to freezing temperatures or when trees fall and damage plumbing systems. Additionally, if storms cause power outages that lead to sump pump failure and basement flooding, some policies provide limited coverage for this scenario.

However, the source and cause of water damage significantly impact coverage decisions. Water damage must result from a covered peril—like wind or hail—rather than gradual deterioration or maintenance issues that allowed water entry over time.

Lightning Strike Protection

Lightning damage coverage extends beyond direct strikes to your home. Standard policies cover damage from electrical surges caused by nearby lightning strikes, including damage to electronics, appliances, and electrical systems throughout your property.

When lightning strikes your home directly, coverage typically includes repairs to structural damage, electrical system replacement, and fire damage if lightning ignites a blaze. Personal property damaged by lightning-induced power surges also receives coverage under most standard policies.

This coverage proves particularly valuable for homeowners with extensive electronic equipment or smart home systems that are vulnerable to electrical surges. Many policies also cover additional living expenses if lightning damage makes your home temporarily uninhabitable.

Storm Damage Exclusions: What’s Not Covered

Flood Damage Limitations

The most significant gap in standard homeowners insurance involves flood damage. Despite common misconceptions, typical policies exclude coverage for flooding, regardless of the storm’s severity or the flood’s cause.

Flood damage includes water that rises from the ground up, storm surge from hurricanes, and overflow from rivers, creeks, or storm drains. Even if a severe thunderstorm causes local flooding that damages your home, standard homeowners insurance won’t cover the repairs.

This exclusion applies even when storms cause the flooding. If hurricane storm surge floods your home or heavy rains overwhelm local drainage systems and flood your property, you’ll need separate flood insurance to cover these damages.

Flood insurance requires a separate policy through the National Flood Insurance Program (NFIP) or private insurers, and coverage typically includes a 30-day waiting period before taking effect. This makes advance planning essential for adequate protection.

Earth Movement Exclusions

Most standard policies also exclude damage from earth movement, including sinkholes, landslides, and erosion that storms might trigger or accelerate. Even if heavy rains cause slope failure that damages your home, standard homeowners insurance typically won’t cover the repairs.

Maintenance-Related Issues

Insurance policies exclude damage that results from lack of maintenance or gradual deterioration. If storms expose existing problems—like damaged roof decking from years of small leaks—insurers may deny claims or limit coverage to only the storm-related portion of the damage.

Filing Your Storm Damage Claim

Documenting Storm Damage Properly

Effective claim documentation begins immediately after storm conditions become safe. Take comprehensive photographs and videos of all visible damage from multiple angles, including wide shots that show the overall scope and close-ups that detail specific problems.

Create a written inventory of damaged personal property, including purchase dates and estimated values when possible. Save receipts for emergency repairs or temporary housing expenses, as these costs may be reimbursable under your policy.

Document the storm itself by saving weather reports, radar images, and official statements from local emergency management agencies. This information helps establish the timeline and severity of the weather event that caused your damage.

Contacting Premier Insurance Consultants of Greenville

Report storm damage to your insurer as quickly as possible, but don’t delay essential emergency repairs while waiting for an adjuster. Most policies require prompt notification and may include provisions for emergency repairs to prevent additional damage.

When speaking with Premier Insurance Consultants Greenville, provide accurate but comprehensive information about the damage you’ve observed. Avoid speculating about causes or making definitive statements about repair costs, as these assessments are best left to professional adjusters and contractors.

Keep detailed records of all communications with your insurance company, including claim numbers, adjuster contact information, and summaries of each conversation. This documentation proves valuable if questions arise during the claims process.

Protecting Your Home and Your Coverage

Understanding your Greenville homeowners insurance coverage empowers you to make informed decisions about additional protection and claim preparation. While standard policies provide solid protection against wind, hail, and lightning damage, significant gaps exist around flood coverage and maintenance-related issues.

Review your policy annually to ensure coverage limits remain adequate for your property’s current value and your personal belongings. Consider whether flood insurance or additional coverage options make sense for your specific situation and location.

Maintain detailed home inventory records and photographs of your property in normal conditions. This preparation streamlines the claims process when storm damage occurs and helps ensure you receive appropriate compensation for covered losses.

For questions about your specific Greenville homeowners insurance coverage or help understanding your policy’s storm damage provisions, contact your local Greenville insurance team, Premier Insurance Consultants of Greenville. Professional guidance helps you navigate coverage options and ensures you have appropriate protection before the next storm arrives.

Disclaimer: Please note that this article is not expert advice. Limitations and conditions may apply. Please check with your local Independent Insurance Agent for details.